RBC

Capital Markets Global Energy and Power Conference

June 7, 2011

Exhibit 99.1 |

RBC

Capital Markets Global Energy and Power Conference

June 7, 2011

Exhibit 99.1 |

1

1

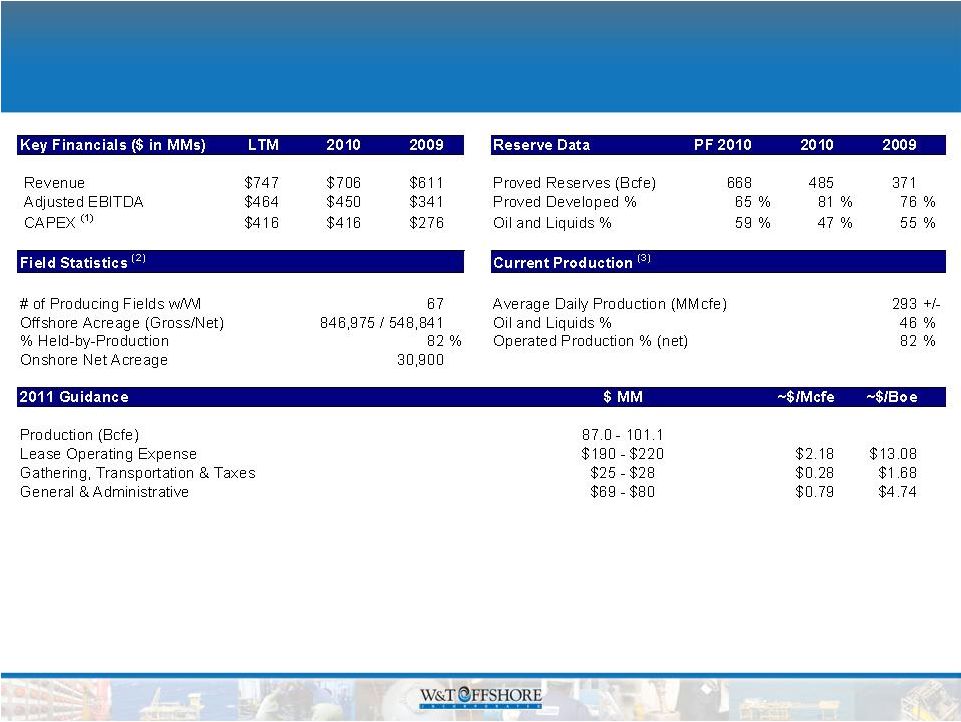

Company Snapshot

(1) Includes acquisition-related CAPEX.

(2) Data as of 12/31/10 for offshore properties. Producing fields include

offshore fields only. (3) Average daily production from 5/11/11 to 5/19/11;

includes recently announced Permian acquisition production of 2,950 Boe/d. |

Key

Investment Considerations •

Strong operating track record with 27+ year history of success in

the Gulf of Mexico

•

High-quality, oil-exposed reserve base with history of reserve

and production growth

•

Strong financial position and healthy liquidity level

•

Conservative operating strategy with drilling budget financed

through internally generated cash flow

•

Proven, experienced management team whose interests align

with all stakeholders (CEO owns over 50% of stock)

|

3

Company Overview

•

Large acreage position in the Gulf of Mexico primarily held by

production

•

Added Permian Basin to the portfolio with acquisition on May 11,

2011

–

Oily, longer-lived proved reserves

–

Provides “predictable growth”

opportunities, and complements GOM

conventional shelf and deepwater assets with high cash flow and upside

potential

–

Reserves to production profile increases to 6.7 years, while oil

and

liquids percentage increases to 59%

•

Continued emphasis on reserve and production growth

•

Strong cash flow focused on full cycle economics

•

Active drilling program with 36 (27 onshore, 9 offshore) wells planned

as part of $310 million capital program |

4

4

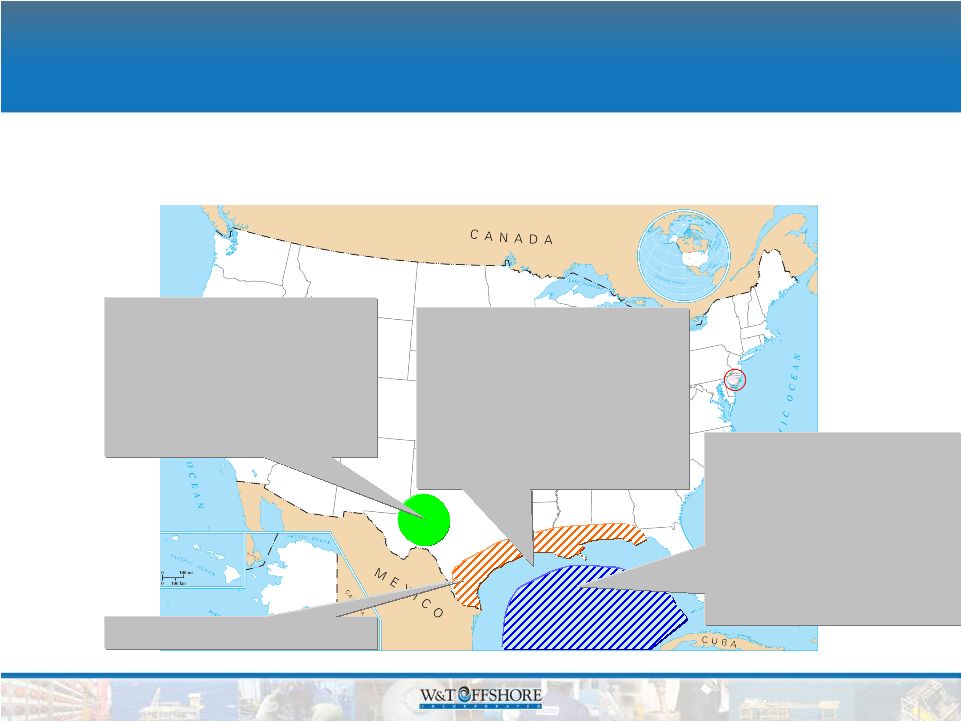

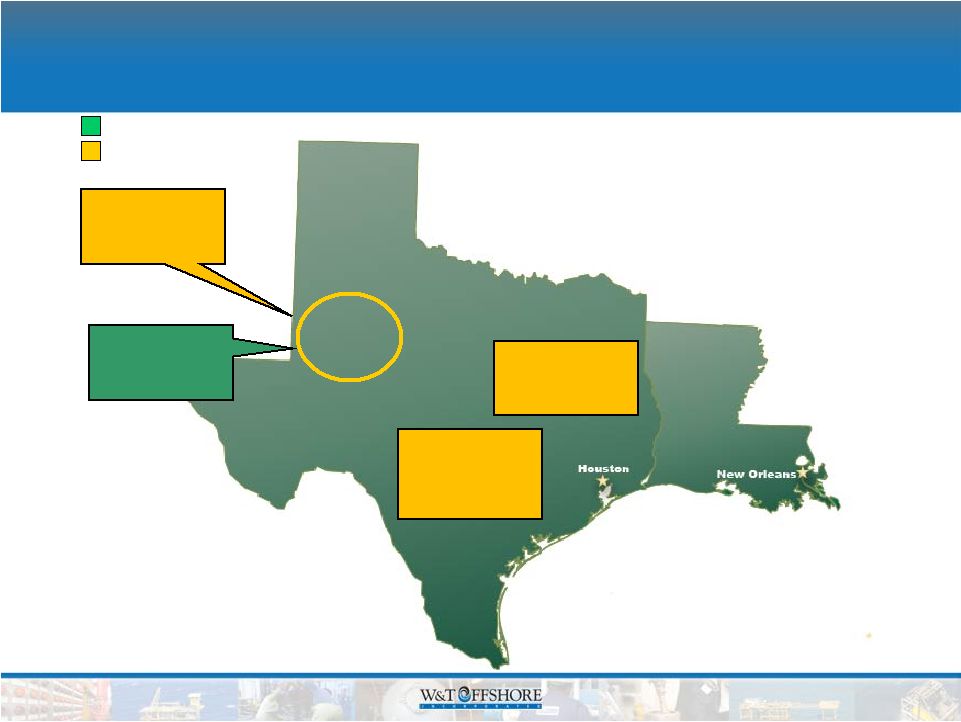

Company Diversification in Progress

•

Since April 2010, we have diversified our existing portfolio by

acquiring producing assets at attractive prices in the deepwater

GOM and the Permian basin

(1) Pro forma for recently announced Permian basin acquisition.

Permian Basin

(1)

•

Proved Reserves: 182 Bcfe

/

30 MMBoe

•

Acreage: 30,900 Net

•

~6% of Production

GOM Deepwater

•

Proved Reserves:

144 Bcfe

/

24 MMBoe

•

Acreage: 137,792 Gross /

93,670 Net

•

~31% of Production

(1)

GOM Shelf

•

Proved Reserves: 341 Bcfe

/

57 MMBoe

•

Acreage: 709,183 Gross /

455,171 Net

•

~62% of Production

(1)

Gulf Coast |

5

5

Strategic Plan

•

Pursue drilling and development of our recently

acquired Permian Basin properties

–

Integrate West Texas operations

•

Expand/acquire acreage positions in onshore prospect

areas

•

Continue evaluations of other potential acquisitions

•

Pursue active and balanced drilling program to increase

reserves and production

–

Historically drilled within internally generated cash flow

|

Onshore |

7

7

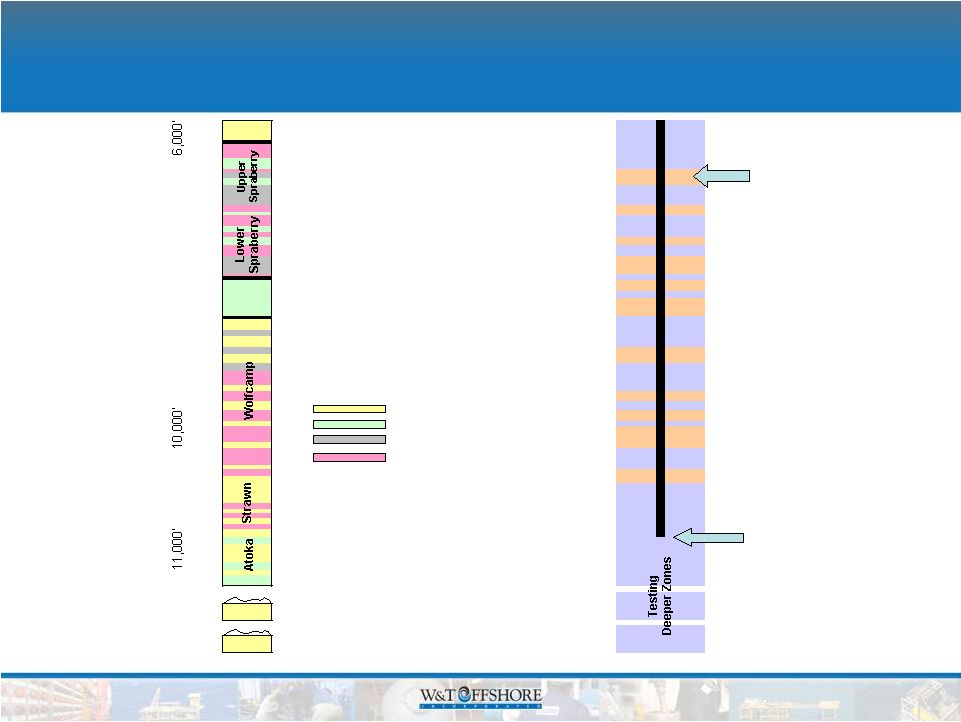

Permian Basin Acquisition Provides Base

for Transformation

•

Signed purchase and sale agreement to acquire approximately

21,900 gross acres (21,500 net acres) from private sellers for

approximately $377 million

•

Strong volumes from proved developed production

–

Current net daily production of about 2,950 BOE

–

Production grew ~55% from 1,900 BOE at Jan. 1, 2011

–

Currently 73 producing wells

•

Proved and probable reserves

–

30 MMBoe of proved reserves

–

25 MMBoe of additional probable reserves

•

Conservative estimates of reserves

–

Analyses assume an average estimated ultimate recovery of ~100 MBoe net

per well for PUDs and 40 acres spacing

•

High ratio of oil and liquid (91%) to gas production and reserves

–

Reserves to production ratio increases to 6.7 years and W&T’s % of oil /

liquids increases to 59% |

8

8

Permian Basin Acquisition Provides

Long-term Growth

•

Low risk operations with a multi-year extensive drilling inventory

–

450 to 500 drilling locations identified for future exploration and

development –

Proved reserves based on 40 acre spacing but certain nearby operators are

using 20 acre spacing

–

3 drilling

and

2

-

4

workover

rigs

continually

working

–

Focused on improving operating efficiency

•

Plan for three drilling rigs working throughout remainder of 2011

–

Primarily targeting the “Wolfberry”

trend, but deeper targets have been tested

and are producing

–

2011 Capital Expenditures of $35 million -

$40 million

–

Anticipate drilling 15 to 20 development wells in 2011

|

9

9

Newly Acquired Assets in West Texas:

Martin, Dawson, Andrews & Gaines Counties |

Wolfberry West Texas Completions *

Limestone Pay

Organic Rich Shale Play

Average Cased Depth

of Wellbore

Fractured Stimulation

Stages

Clear-

fork

Dean

Non-organic Shale Non-pay

Sandstone Play

12,500’

13,250’

Devonian

Silurian

* Not drawn to scale. |

11

11

Other Onshore Activities

•

In addition to our West Texas Permian Basin acquisition, we are actively

involved: –

In South Texas –

•

Our initial well, in which we have a 25% non-operating working interest (WI),

was completed and found 22 feet of gas and condensate. This area has

potential for additional drilling opportunities.

–

In West Texas –

•

We

have

also

acquired

about

9,400

net

acres

in

the

Permian

Basin

through

leasing

and

farm-outs and expect to have about seven exploratory wells drilled before the

end of the year. Working interests vary; we should operate three or

four of such exploratory wells. –

In East Texas –

•

Our

first

well

reached

total

depth

in

April.

Due

to

downhole

problems

in

this

non-operated

well, a sidetrack operation was commenced early in May and should be again at

total depth in July. The original operation found both conventional

and unconventional reservoirs. We had a 25% WI in the original well

and have increased our participation to about 35% in the subsequent

operation. This area has potential for additional drilling opportunities. |

12

12

Onshore 2011 Drilling Program

South Texas

WI: 50%

2 Wells

East Texas

WI: 25%

1 well

Exploration

Development

West Texas

WI: 25% to 100%

7 -

8 Wells

West Texas

WI: 100%

15 –

20 Wells

•

In addition to the recently announced

Permian acquisition, we have also

acquired 9,400 net exploratory acres in

the Permian basin |

Gulf

of Mexico |

14

Gulf of Mexico Highlights

•

Strong operating track record

–

10 year exploration drilling success rate of 77% and 10 year development drilling

success rate of 91%

–

Proved reserve replacement rate of 231% in 2010

–

Excellent safety track record and culture of operating success

–

All-in F&D costs in 2010 of $2.59/Mcfe

•

Large acreage position

•

Great history of production and reserves

–

Highly prolific with multiple pay zones

–

Reserves at deeper but virtually untapped zones, significant upside

potential –

Established infrastructure on shelf

–

Substantial percentage of oil reserves

–

Reserve to production profile is consistent

•

Attractive reservoir characteristics

–

High porosity rock provides quick return on investment

–

Cash flow velocity significantly higher than most other basins

–

Balanced growth opportunities (high impact or low risk)

•

Costs historically adjust quickly to commodity prices due to shorter

contract terms |

15

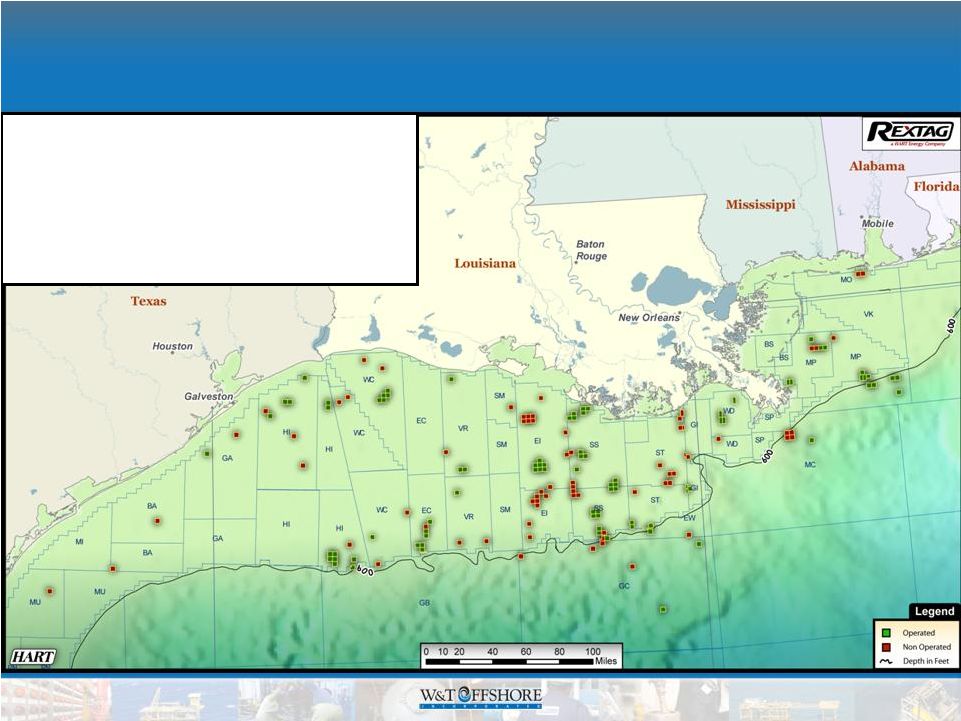

15

Gulf of Mexico Proved Reserve with

Geographic Diversification

•

67 fields

•

80% operated

•

846,975 gross acres, 548,841 net acres

•

82% held by production

•

Producing 274 MMcfe

per day

•

44% oil & liquids / 56% gas |

16

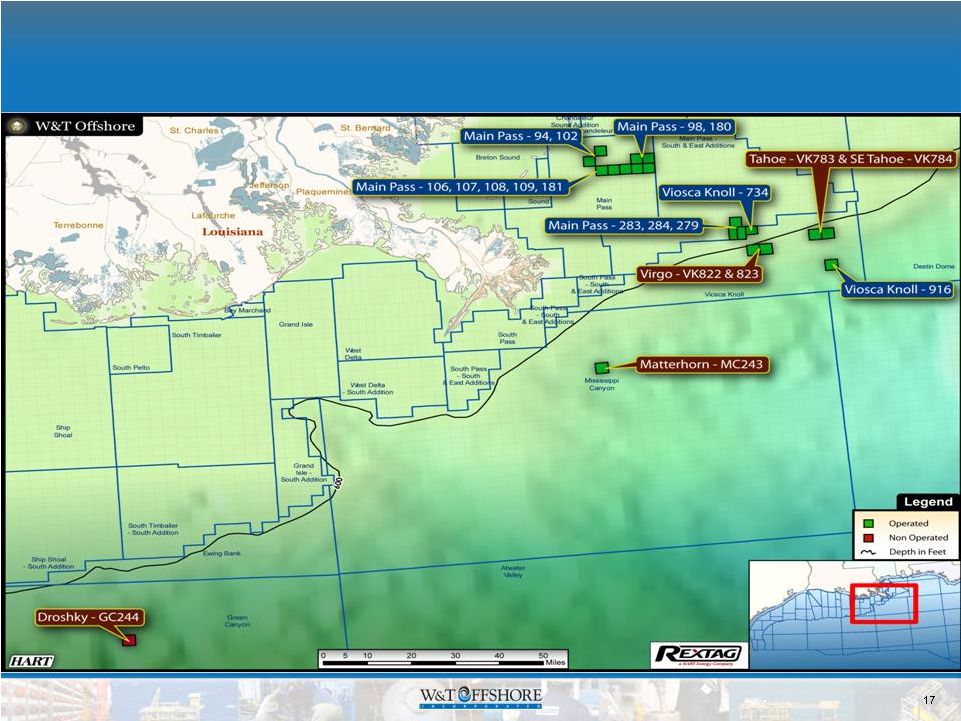

Gulf of Mexico Recent Activity

•

We are integrating two purchases closed in 2010 consisting of

virtually all proved, producing reserves

–

We

acquired

two

properties

from

Total

and

closed

the

acquisition

on

5/3/10

–

We acquired three properties from Shell and closed 11/3/10

•

Currently working to close a fourth Shell property consisting

of virtually all proved, producing reserves

•

Restored production to the Main Pass 108 Field early in the

2011 second quarter

–

Current net production amounts to about 42MMcfe per day, or 35 MMcf

and 1,300 barrels per day

•

Successfully drilled one exploratory well at Main Pass 180 and

a development sidetrack at our MP 108 D-3 well

•

Anticipate drilling three more exploratory wells and four

development wells offshore this year |

17

17

Concentrated Operations in Recently

Acquired GOM Fields and Focus Areas |

18

18

Offshore 2011 Drilling Program

Viosca Knoll

Mississippi Canyon

Atwater Valley

Green Canyon

Garden Banks

East Breaks

Mustang

Island

Matagorda

Island

Brazos

Galveston

High

Island

E.

Cameron

Vermilion

Eugene

Island

Ship

Shoal

South

Timbalier

Ewing

Bank

West

Delta

Grand

Isle

Main

Pass

S. and E.

Main

Pass

W.

Cameron

Exploration

Development

MP 180 A-2

WI: 100%

Shelf

(Drilled and

successful)

MP 108 #8 & Tex W5

WI: 75%

Shelf

West Cameron 73 #2

WI: 30%

Deep Shelf

Deepwater

Prospect

WI: 20%

MP 108 D-3 ST

WI: 100%

Shelf

(Drilled and successful)

SS 349 E

WI: 100%

Shelf

ST 316 A-2 ST

WI: 40%

Shelf

SS 349 B

WI: 100%

Shelf |

19

Regulatory Developments --

Deepwater

•

Permits approved for 14 unique deepwater wells since

drilling was halted after last year’s spill

•

Well

control

options

–

Operators

to

show

how

they

would

respond to subsea well control issue.

–

Helix Well Containment Group (HWCG)

–

Marine Well Containment Company (MWCC)

–

Total Deepwater Solution (TDWS)

•

W&T has executed a contract with HWCG

•

The first 3 approved deepwater drilling permit were

members of the HWCG |

Other

Operational and Financial Information |

PDP

41%

PDNP

24%

PUD

35%

21

21

Proved Reserves

PDP

49%

PDNP

32%

PUD

19%

Pro Forma 2010

2010

485

Bcfe

668

Bcfe |

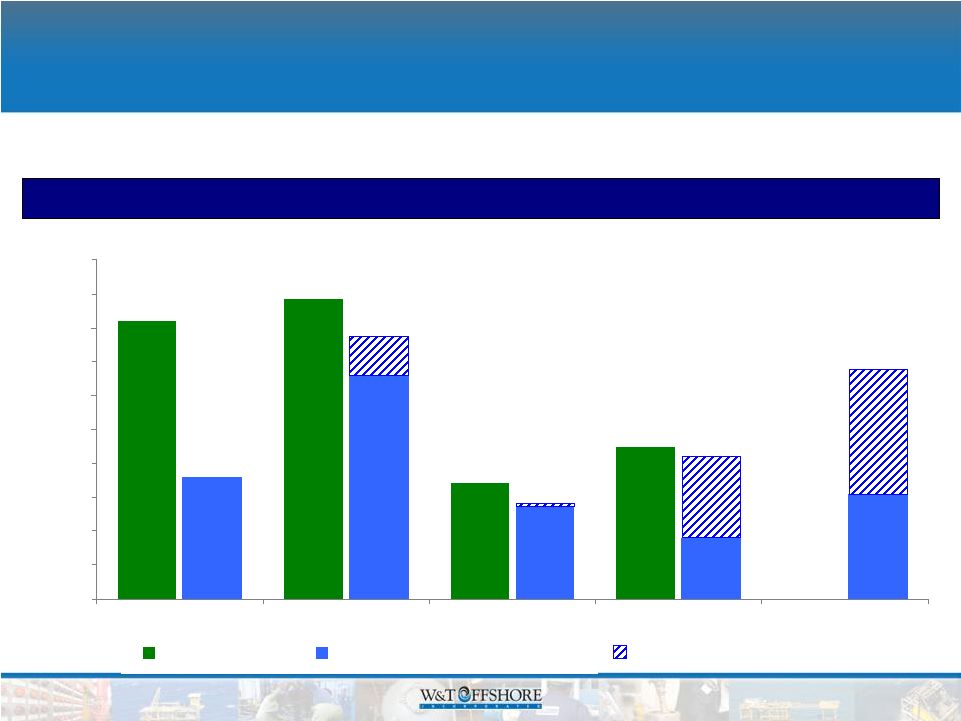

22

22

Drilling Within Cash Flow

Adjusted EBITDA vs. Capital Expenditures

($ in millions)

Capital

expenditures

funded

largely

through

internally

generated

cash

flow

$884

$820

$341

$450

$687+

$416

$276

$775

$359

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

2007

2008

2009

2010

2011E

Adj. EBITDA

CAPEX, Excl. Acquisitions

Acquisition CAPEX

$884

$820

$341

$450

$687+

$416

$276

$775

$359

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

2007

2008

2009

2010

2011E

Adj. EBITDA

CAPEX, Excl. Acquisitions

Acquisition CAPEX

Estimate |

23

23

Liquidity Profile

•

Cash balance at May 25, 2011 ~ $71 million

•

New four-year revolver with $525 million borrowing base

–

Borrowing base increases to $575 million when the fourth Shell

property closes

–

The newly acquired Permian Basin assets have yet to be

considered for an increase to the borrowing base

–

~$150 million drawn on revolver pro forma for Permian

acquisition and new high yield bond offering

•

Net cash provided by operating activities $464.8 million

for 2010 |

Appendix |

25

The following table presents a reconciliation of our consolidated net income to

consolidated EBITDA to Adjusted EBITDA:

We define EBITDA as net income (loss) plus income tax expense (benefit), net

interest expense (which includes interest income), depreciation, depletion,

amortization and accretion and impairment of oil and natural gas properties. Adjusted EBITDA excludes

the loss on extinguishment of debt and the unrealized gain or loss related to our

derivative contracts. Although not prescribed under GAAP, we believe

the presentation of EBITDA and Adjusted EBITDA provide useful information regarding our ability to

service debt and fund capital expenditures and they help our investors understand

our operating performance and make it easier to compare our results with

those of other companies that have different financing, capital and tax structures. EBITDA and

Adjusted

EBITDA

should

not

be

considered

in

isolation

from

or

as

a

substitute

for

net

income,

as

an

indication

of

operating

performance or cash flow from operating activities or as a measure of

liquidity. EBITDA and Adjusted EBITDA, as we calculate them, may not

be comparable to EBITDA and Adjusted EBITDA measures reported by other companies. In addition, EBITDA and

Adjusted EBITDA do not represent funds available for discretionary use.

Reconciliation of Net Income to EBITDA

Twelve Months

Ended

March 31,

2007

2008

2009

2010

2010

2011

2011

($ in thousands)

Net income

144,300

$

(558,819)

$

(187,919)

$

117,892

$

42,315

$

18,649

$

94,226

$

Income taxes (benefit)

71,459

(269,663)

(74,111)

11,901

4,020

10,182

18,063

Net interest expense (income)

30,684

21,337

39,245

36,996

9,376

8,717

36,337

Depreciation, depletion,

amortization and accretion

532,910

521,776

342,537

294,100

69,209

74,092

298,983

Impairment of oil and natural gas

properties

--

1,182,758

218,871

--

--

--

--

EBITDA

779,353

897,389

338,623

460,889

124,920

111,640

447,609

Loss on extinguishment of debt

2,806

--

2,926

--

--

--

--

Unrealized derivatives loss (gain)

37,831

(13,501)

5,370

9,511

(5,109)

21,617

36,237

Royalty relief recoupment

--

--

--

(24,881)

--

--

(24,881)

Transportation allowance

--

--

(5,558)

4,687

--

--

4,687

Adjusted EBITDA

819,990

$

883,888

$

341,361

$

450,206

$

119,811

$

133,257

$

463,652

$

Year Ended December 31,

Three Months Ended

March 31, |

26

Forward-Looking Statement Disclosure

This

presentation,

contains

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995, Section 27A of the Securities Act and Section 21E of the Exchange Act.

Forward-looking statements give our current expectations or forecasts of

future events. They include statements regarding our future operating and financial performance.

Although we believe the expectations and forecasts reflected in these and other

forward-looking statements are reasonable, we can give no assurance they

will prove to have been correct. They can be affected by inaccurate assumptions or by known

or unknown risks and uncertainties. You should understand that the following

important factors, could affect our future results and could cause those

results or other outcomes to differ materially from those expressed or implied in the forward-looking

statements

relating

to:

(1)

amount,

nature

and

timing

of

capital

expenditures;

(2)

drilling

of

wells

and

other

planned

exploitation

activities; (3) timing and amount of future production of oil and natural gas; (4)

increases in production growth and proved reserves; (5) operating costs such

as lease operating expenses, administrative costs and other expenses; (6) our future

operating or financial results; (7) cash flow and anticipated liquidity; (8) our

business strategy, including expansion into the deep shelf and the deepwater

of the Gulf of Mexico, and the availability of acquisition opportunities; (9) hedging strategy; (10)

exploration and exploitation activities and property acquisitions; (11) marketing

of oil and natural gas; (12) governmental and environmental regulation

of the oil and gas industry; (13) environmental liabilities relating to potential pollution arising from our

operations; (14) our level of indebtedness; (15) timing and amount of future

dividends; (16) industry competition, conditions, performance and

consolidation; (17) natural events such as severe weather, hurricanes, floods, fire and earthquakes; and (18)

availability of drilling rigs and other oil field equipment and services.

We caution you not to place undue reliance on these forward-looking statements,

which speak only as of the date of this presentation or as of the date of

the report or document in which they are contained, and we undertake no obligation to update

such

information.

The

filings

with

the

SEC

are

hereby

incorporated

herein

by

reference

and

qualifies

the

presentation

in

its

entirety.

Cautionary Note to U.S. Investors

The

United

States

Securities

and

Exchange

Commission

permits

oil

and

gas

companies,

in

their

filings

with

the

SEC,

to

disclose

only

proved

reserves

that

a

company

has

demonstrated

by

actual

production

or

conclusive

formation

tests

to

be

economically and legally producible under existing economic and operating

conditions. U.S. Investors are urged to consider closely the

disclosure in our Form 10-K for the year ended December 31, 2010, available from us at Nine Greenway Plaza,

Suite 300, Houston, Texas 77046. You can obtain these forms from the SEC by

calling 1-800-SEC-0330. |

W&T Offshore, Inc. (NYSE: WTI)

Nine Greenway Plaza

Suite 300

Houston, TX 77046

Main line -

713-626-8525

Fax -

713-626-8527

Investor

Relations

-

713-297-8024

www.wtoffshore.com

www.investorrelations@wtoffshore.com |